The Million-Dollar Myth: Why Your Digital Transformation Doesn’t Need a Million Dollars in Cash

If you’re a CFO in a mid-market firm, there are few phrases more likely to induce a mild tension headache than “Digital Transformation.”

It usually starts with a pitch. A well-meaning colleague, perhaps the CIO or a particularly enthusiastic Head of Growth walks into your office with sleek diagrams, promises of “seamless integration,” charts looking like Kookaburra’s finest Hockey Sticks and a price tag that looks like a phone number. They talk about “future-proofing” and “agile ecosystems,” while you’re looking at the balance sheet and wondering which vital organ the business will have to sell to fund the next three years of implementation.

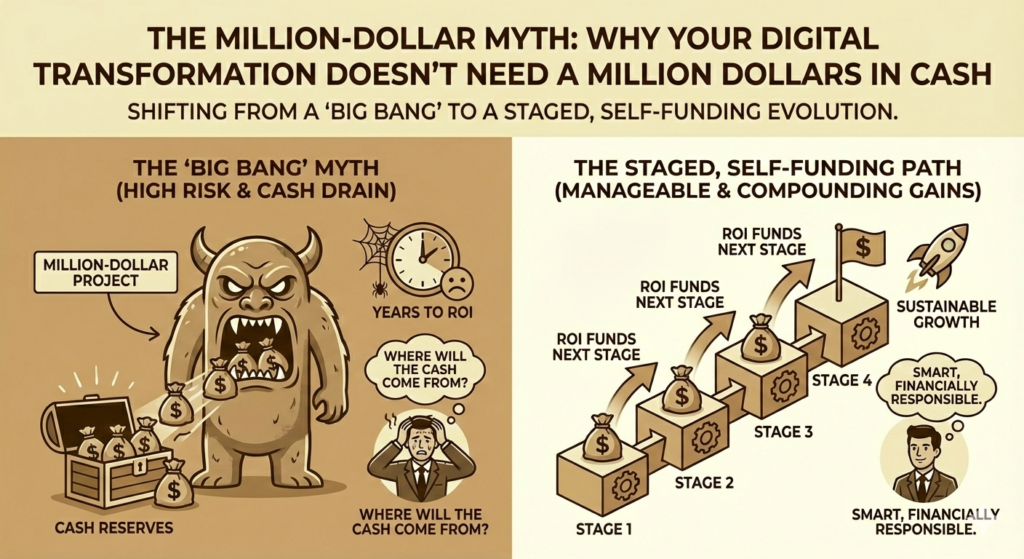

The traditional view is often that digital transformation is a monolithic, multi-year event. It’s a giant, hungry beast that lives under the stairs, consuming capital at an alarming rate while offering very little in the way of immediate sustenance. Viewed in isolation, this perspective has an argument to say that it is correct. Viewed as a whole, transformations can take years. They can cost millions. And frankly, they often do.

But here is the secret that the “Big Tech” consultants rarely mention: A million-dollar transformation project sometimes doesn’t actually need a million dollars of cash sitting in the bank.

In fact, if you approach it with a bit of financial pragmatism and correctly setting stakeholder expectations, it’s entirely possible for an organisation-wide transformation to go a long way to paying for itself within the annual budgetary cycle.

The Problem with the "Big Bang"

Many digital transformations fail not because the technology or the targeted outcomes are bad, but because the financial structure and the way the data gets reported puts financial strain on the business.

The “Big Bang” approach, where you commit to a massive upfront spend and hope to see a return three years down the track is the corporate equivalent of jumping out of a plane and trying to sew the parachute together on the way down.

For a mid-market company, this creates a massive risk to cash flow. You’re burning cash today for a promise of efficiency tomorrow. And as any CFO knows, “tomorrow” is a very long time in a volatile market.

We see this often at The Distillery. Someone wants “The complete AI Solution” or “The Fully integrated Global ERP” because they’ve been told it’s the only way forward. There’s plenty of data and reasoning to support the position, but it’s simply just too much cash for the business to tie up, so the point is moot regardless of the proposed outcomes.

There is, however, a more sophisticated way to play the game.

Breaking the Monolith: The “Liquidating” Stage

Rather than treating transformation as one giant, immovable object, we prefer to break it down into a series of tangible, ‘bite-sized’ stages.

The goal? As much as it is possible (and it’s not always possible), each stage can be designed to liquidate its own cost through a measurable uplift in business performance within the budget cycle.

The project is designed around a self-funding roadmap. Instead of one $1.2M project, you have four $300k stages. If Stage 1 is designed correctly, the efficiencies, cost savings, or revenue uplifts it generates should ideally cover the cost of Stage 2.

Importantly stages are also designed to be independent and the completion of any stage creates the opportunity but not the obligation to proceed to the next stage.

When you sit down with your transformation partner, they should be speaking the language of your P&L and not just Python. Together you should be asking: “What is the right mix to generate an ROI which we can then reinvest?”

The Layering Effect: 90 Days On, 90 Days Off

At The Distillery, after we have thoroughly mapped out the transformation roadmap & depending on the needs of the customer, we often advocate for a “90 on, 90 off” cadence.

- 90 Days On: A sprint of focused activity. We build, we integrate, we deploy.

- 90 Days Off: New build stops.This time is used to settle in the change. We train the staff. We measure the ROI. We review the outcomes, revisit the plan and tweak the processes to ensure the promised gains are actually hitting the bottom line and that the next proposed stage is updated with the latest real-world information.

We call this the Self-Improvement Cycle and the approach acknowledges a few simple truths:

- The human element of a business (your staff and your customers) has a finite capacity for change. If you feed the animal too much at once, you get indigestion.

- Even the best thought through plans are rarely right. You need to insert the break points in between stages to take on board the real world impacts of the changes you just made and adapt accordingly.

By layering these stages, the payback comes sooner each time. You aren’t just saving money; you’re compounding your gains. By the time you’re halfway through the “million-dollar” roadmap, the business is often performing at a level where the net cash impact of the remaining stages can be negligible…or even positive.

Designing for the CFO, Not Just the CIO

To make this work, the transformation can’t just be a “tech project.” It becomes a financial strategy. This is where close consultation with the CFO is non-negotiable.

We look for the leak indicators in the business.

- Is your staff working harder than ever but getting through less work because of manual data entry?

- Are you losing customers to competitors because your interface feels like a relic of the dial-up era?

- Are you paying for three different SaaS platforms that all do the same thing?

Often, the most profound business improvements don’t come from some magical AI solution (though we love a good AI solution where appropriate), but from fixing starting with getting basics already in place optimised. Sometimes the best ROI comes from a well-designed database or a streamlined process that doesn’t require three sign-offs for a coffee order.

When we identify these “quick wins” and generally seek to sequence them first, assisting in creating some cash flow “breathing room” required for the more complex, long-term innovations.

The Scarcity of Genuine Expertise

There is a catch, of course. (There’s always a catch.)

The market is currently flooded with people selling “AI tokens” and “digital overhauls.” But there is a growing scarcity of partners who actually understand the intricate intersection of business acumen, technology, and—most importantly—human behavior.

As I’ve mentioned in previous articles, your staff are the engine of your business, and your customers are the oxygen. If a digital transformation partner can’t explain how their $500k phase will make your staff’s lives easier or your customers’ experience better, they aren’t a transformation partner. They’re a software vendor.

In Adelaide, and indeed across Australia, the “good ones” are booking out. The firms that can actually bridge the gap between a balance sheet and a backend architecture are becoming rare gems. If you aren’t already scoping your path, you might find yourself at the back of a very long queue, watching your more agile competitors fund their own evolution while you’re still debating the merits of carrier pigeons.

The Low-Risk First Step: Discovery and Scoping

If the thought of a multi-year commitment still makes your eye twitch, don’t start there.

The most fiscally responsible thing a CFO can do is authorise a Discovery and Scoping process (Potentially in combination with our Facilitated Innovation program). This isn’t a commitment to a million-dollar project. It’s the process of getting a detailed map before you start the journey.

A proper discovery phase will:

- Identify the highest-impact “leaks” in your current system.

- Scope out the “90 on 90 off” stages.

- Assign hard ROI metrics to each stage.

- Optimise towards the lowest total cost of ownership and cash-flow impact.

It allows you to make decisions based on data, not FOMO. It puts you back in the driver’s seat, ensuring that the technology is the horse and the business goals are the cart, not the other way around.

Final Thoughts

Digital transformation doesn’t have to be an all consuming beast. There will be a leap of faith. However it can be minimised. It can be a modelled, staged, and ultimately it can potentially be a self-funding evolution of your business.

Bottom line: A million-dollar project doesn’t necessarily need a million dollars of cash. It just needs a plan that involves support from the finance team right from the start.